While unearned revenue is cash obtained earlier than doing the work, and it’s recorded as a legal responsibility. Deferrals are cash you spend, before getting any actual revenue or service. With accounting software, then again, it’s lots tougher to make errors. And even if you do, the software program routinely spots it and notifies you of a mismatch.

Closing Course Of Overview

Next, the professionals learn the collected knowledge, verify each transaction that occurred, and notice the reasons that led to these transactions. Lastly, they put it underneath the best label and decide their influence on different accounts based on their analysis. A bookkeeper or accountant keeps track and records all financial accounting actions for that particular monetary year.

For instance, posting a journal entry for $1,500 lease includes debiting Expense and crediting Cash with the identical quantity. To prevent misclassification errors, make positive that accounting workers have a transparent understanding of account classifications and constantly apply classification guidelines to transactions. Implementing a standardized chart of accounts and conducting common critiques of transaction classifications may help identify and correct misclassifications promptly.

Some corporations prepare monetary statements on a quarterly foundation whereas different corporations prepare them annually. This means that quarterly companies full one whole accounting cycle every three months whereas annual firms solely full one accounting cycle per year. To guarantee consistency and transparency in financial reporting, companies in the united states adhere to Typically Accepted Accounting Rules (GAAP).

The preparation of a trial balance is an important step in the accounting cycle, involving the compilation and verification of ledger balances’ accuracy. It presents a sequential document of economic transactions and acts because the foundational doc for transferring info to ledger accounts. Well Timed monetary reporting offers stakeholders with up-to-date information about the corporate’s financial efficiency, enabling them to make timely choices and take corrective actions if needed. The monetary statements it produces supply very important insights into a company’s monetary health, liquidity, and solvency. Such knowledge permits administration to discern patterns, assess profitability, and distribute assets efficiently.

How Does Gaap Have An Result On Monetary Reporting?

This e-book can also be called the e-book of authentic entry as a end result of this is the first report the place transactions are entered. In a journal, the transactions are entered in a chronological order, i.e., as and when they happen in business. Posting to the Ledger entails transferring the journal entries to the Common Ledger. Whereas Nine Steps In The Accounting Cycle journaling records transactions chronologically, posting organizes them by account, updating the balances of every account.

Efficient inner controls involve the segregation of duties, common audits, and clear approval processes. Ignoring these practices can compromise the integrity and reliability of financial info. Reviewing and updating monetary insurance policies and procedures frequently ensures alignment with regulatory requirements and business requirements. Updated policies promote consistency, transparency, and compliance in financial operations. Investing in ongoing training and development for accounting staff is crucial for keeping them updated with industry trends, best practices, and software program developments.

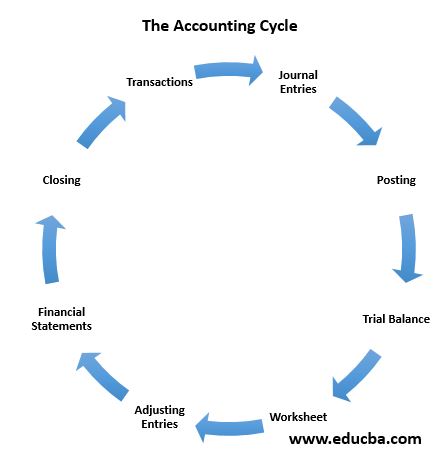

Preserving the general ledger updated is important to avoid penalties and guarantee correct information. By posting transactions and running trial balances, you possibly can spot errors from invoicing or billing. The cycle begins with finding transactions and ends with closing the books after making financial statements. Utilizing the cycle helps maintain data balanced and reveals the value of accounting for making selections.

Analyzing transactions is the primary step as a end result of it entails identifying and understanding the financial transactions that need to be recorded. This step ensures that every one related data is captured accurately from source documents. The Accounting Cycle is a nine-step standardized follow used by organizations & CPA firms to record and calculate financial transactions & activities. The Accounting Cycle steps list the method of analyzing, monitoring, and figuring out a company’s financial transactions. It is used for its effectivity and compliance with federal rules and tax codes. Following the eight-step accounting cycle may help you precisely report all monetary transactions, catch and correct errors and balance your books on the finish of every fiscal year earlier than you close them.

- As Quickly As credit are discovered to be equal to debit, monetary statements are ready.

- The accounting cycle interval can differ, however most businesses function on a month-to-month, quarterly, or annual cycle.

- Also, if there is inequality, then the purpose being investigated and corrected earlier than moving to the following step.

- However, these cycles differ with respect to when and for what these transaction details are to be recorded.

- It includes the date, description of the transaction, and debit and credit amounts.

- The preparation of a trial stability is a vital step in the accounting cycle, involving the compilation and verification of ledger balances’ accuracy.

Key steps embrace figuring out transactions, recording journal entries, posting to the ledger, making ready trial balances, making adjustments, and creating financial statements. The course of ends with closing momentary accounts and starting a new cycle. The unadjusted trial balance is a crucial step in the accounting cycle as it provides a abstract of all of the ledger accounts and their respective balances earlier than any adjustments are made. Its function is to make sure that whole debits equal whole credit, which is important for the accuracy and integrity of financial statements.

Understanding the working cycle helps businesses optimize inventory https://www.quickbooks-payroll.org/ levels, handle cash move effectively, and improve general operational efficiency. Well Timed preparation of monetary statements additionally allows companies to comply with tax filing deadlines and supply needed info to tax authorities, minimizing the chance of penalties or audits. After successfully completion of nine steps in accounting cycle, the new accounting period (fiscal year) begins and new accounting cycle starts from step 1. By performing these checks diligently, you help maintain accuracy in your monetary reporting.